Optimise your remuneration governance with an effective remuneration framework

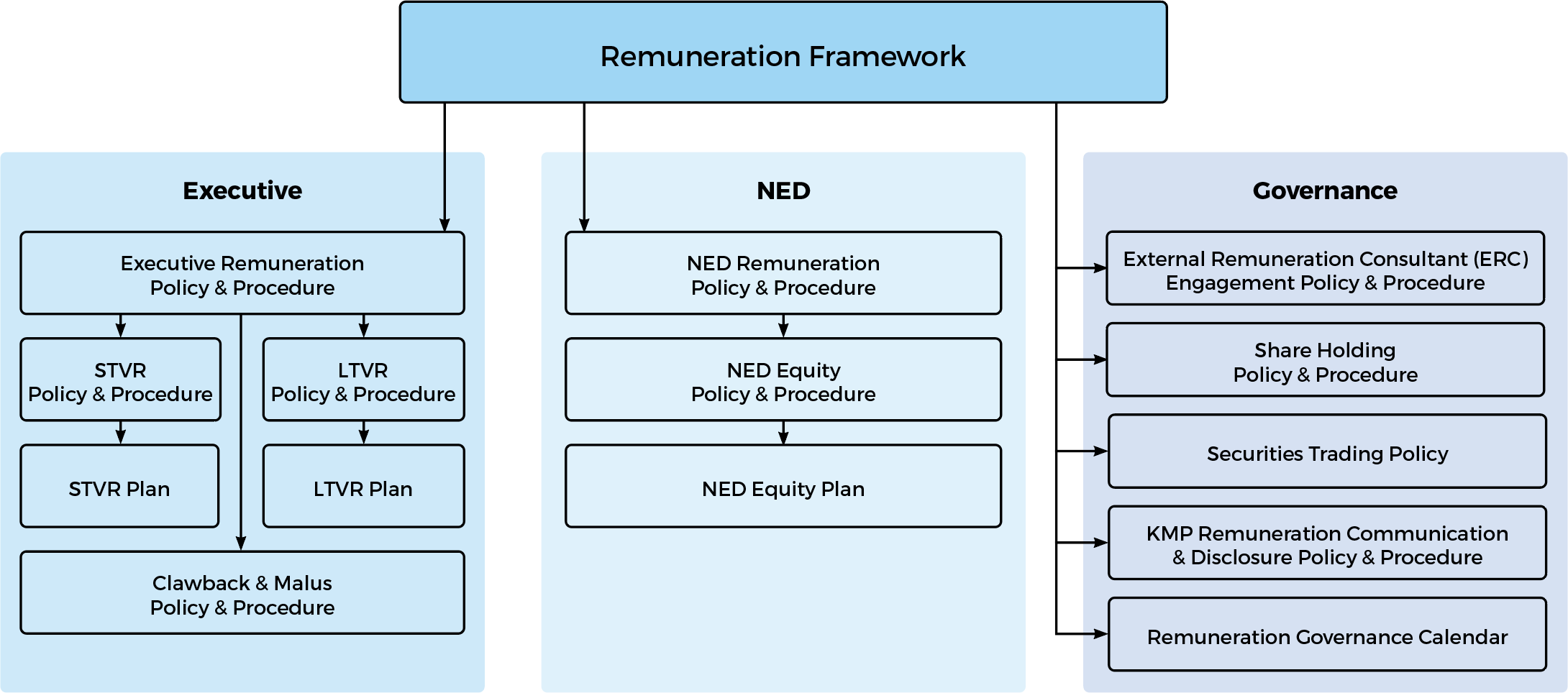

A remuneration framework defines the company’s remuneration governance system, purpose, strategy, and commitment to appropriately and consistently managing KMP remuneration matters for the organisation. The framework will define what policies, procedures, incentive plan rules and controls are needed for overall good governance and will be the point of reference for remuneration decision making.

APRA regulated entities are required to engage an independent party to review their remuneration framework against the requirements of APRA CPS 511 and CPG 511, and to assess efficacy, at least once every 3 years. Further, a remuneration framework also must be reviewed and updated to comply with an evolving regulatory landscape, as changes can significantly impact corporate remuneration requirements, with a risk on noncompliance. Areas of consistent review that impact remuneration governance are:

- The Corporations Act 2001

- ASX Listing Rules and Guidance Notes

- ASX Corporate Governance Council’s Principles and Recommendations

- ASIC Regulations and Guidelines

- Employee Share Scheme taxing provisions

- APRA – Requirements for APRA Regulated Entities

Over time we have also observed that with board turnover and role changes, committees can end up “reinventing the wheel” each time they revisit an issue, particularly when aspects of remuneration are only deeply reviewed each three years or so, such as in the case of long term incentives. Many problems arise from inconsistent decision making and the lack of a commonly shared or agreed set of principles that are best outlined in a framework and can serve to efficiently inform and align new board or committee members.

GRG creates capabilities that improve your remuneration framework, corporate governance and strategies

Remuneration committees and/or decision makers use GRG as a trusted advisor to develop, review and draft KMP remuneration governance frameworks that overcome the inevitable changes in both board composition and governance landscape.

We aim to provide capabilities for:

- A foundation for optimal performance and decision making of the board

- Alignment and transparency of performance and rewards

- Effective management of incentives related to conduct risk

- Strike Risk Management and other Risks, such as regulatory noncompliance

- Transparency for all stakeholders/ shareholders and KMP.

FAQ: What are the components of an effective Remuneration Framework?

Find out more about

GRG’s Remuneration Framework services

Our team are here to help. Find out how GRG can assist with your remuneration framework. GRG have multiple solutions that provide boards with additional capabilities that improve corporate governance and strategies, including:

- Independent review as required by APRA

- Advice to optimise your framework and its elements

- Policy templates

- Bespoke policy drafting – tailored to the needs of your remuneration committee, regulators and shareholders